There are broadly two ways of controlling inflation in an economy:

1). Monetary measures and

2). Fiscal measures

I).Monetary Measures

The most important and commonly used method to control inflation is monetary policy of the Central Bank. Most central banks use high interest rates as the traditional way to fight or prevent inflation.

Monetary measures used to control inflation include:

(i) bank rate policy

(ii) cash reserve ratio and

(iii) open market operations.

Bank rate policy is used as the main instrument of monetary control during the period of inflation. When the central bank raises the bank rate, it is said to have adopted a dear money policy. The increase in bank rate increases the cost of borrowing which reduces commercial banks borrowing from the central bank. Consequently, the flow of money from the commercial banks to the public gets reduced. Therefore, inflation is controlled to the extent it is caused by the bank credit.

Cash Reserve Ratio (CRR) : To control inflation, the central bank raises the CRR which reduces the lending capacity of the commercial banks. Consequently, flow of money from commercial banks to public decreases. In the process, it halts the rise in prices to the extent it is caused by banks credits to the public.

Open Market Operations: Open market operations refer to sale and purchase of government securities and bonds by the central bank. To control inflation, central bank sells the government securities to the public through the banks. This results in transfer of a part of bank deposits to central bank account and reduces credit creation capacity of the commercial banks.

Stimulating economic growth

If economic growth matches the growth of the money supply, inflation should not occur when all else is equal.[61] A large variety of factors can affect the rate of both. For example, investment in market production, infrastructure, education, and preventative health care can all grow an economy in greater amounts than the investment spending.[62][63]Monetary policy

Main article: Monetary policy

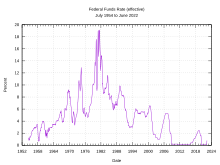

Today the primary tool for controlling inflation is monetary policy.

Most central banks are tasked with keeping their inter-bank lending

rates at low levels, normally to a target rate around 2% to 3% per

annum, and within a targeted low inflation range, somewhere from about

2% to 6% per annum. A low positive inflation is usually targeted, as

deflationary conditions are seen as dangerous for the health of the

economy.There are a number of methods that have been suggested to control inflation. Central banks such as the U.S. Federal Reserve can affect inflation to a significant extent through setting interest rates and through other operations. High interest rates and slow growth of the money supply are the traditional ways through which central banks fight or prevent inflation, though they have different approaches. For instance, some follow a symmetrical inflation target while others only control inflation when it rises above a target, whether express or implied.

Monetarists emphasize keeping the growth rate of money steady, and using monetary policy to control inflation (increasing interest rates, slowing the rise in the money supply). Keynesians emphasize reducing aggregate demand during economic expansions and increasing demand during recessions to keep inflation stable. Control of aggregate demand can be achieved using both monetary policy and fiscal policy (increased taxation or reduced government spending to reduce demand).

Fixed exchange rates

Main article: Fixed exchange rate

Under a fixed exchange rate currency regime, a country's currency is

tied in value to another single currency or to a basket of other

currencies (or sometimes to another measure of value, such as gold). A

fixed exchange rate is usually used to stabilize the value of a

currency, vis-a-vis the currency it is pegged to. It can also be used as

a means to control inflation. However, as the value of the reference

currency rises and falls, so does the currency pegged to it. This

essentially means that the inflation rate in the fixed exchange rate

country is determined by the inflation rate of the country the currency

is pegged to. In addition, a fixed exchange rate prevents a government

from using domestic monetary policy in order to achieve macroeconomic

stability.Under the Bretton Woods agreement, most countries around the world had currencies that were fixed to the US dollar. This limited inflation in those countries, but also exposed them to the danger of speculative attacks. After the Bretton Woods agreement broke down in the early 1970s, countries gradually turned to floating exchange rates. However, in the later part of the 20th century, some countries reverted to a fixed exchange rate as part of an attempt to control inflation. This policy of using a fixed exchange rate to control inflation was used in many countries in South America in the later part of the 20th century (e.g. Argentina (1991–2002), Bolivia, Brazil, and Chile).

Gold standard

Main article: Gold standard

The gold standard was partially abandoned via the international adoption of the Bretton Woods System. Under this system all other major currencies were tied at fixed rates to the dollar, which itself was tied to gold at the rate of $35 per ounce. The Bretton Woods system broke down in 1971, causing most countries to switch to fiat money – money backed only by the laws of the country.

According to Lawrence H. White, an F. A. Hayek Professor of Economic History "who values the Austrian tradition",[64] economies based on the gold standard rarely experience inflation above 2 percent annually.[65] However, historically, the U.S. saw inflation over 2% several times and a higher peak of inflation under the gold standard when compared to inflation after the gold standard.[66] Under a gold standard, the long term rate of inflation (or deflation) would be determined by the growth rate of the supply of gold relative to total output.[67] Critics argue that this will cause arbitrary fluctuations in the inflation rate, and that monetary policy would essentially be determined by gold mining.[68][69]

Wage and price controls

Main article: Incomes policies

Another method attempted in the past have been wage and price

controls ("incomes policies"). Wage and price controls have been

successful in wartime environments in combination with rationing.

However, their use in other contexts is far more mixed. Notable failures

of their use include the 1972 imposition of wage and price controls by Richard Nixon. More successful examples include the Prices and Incomes Accord in Australia and the Wassenaar Agreement in the Netherlands.In general, wage and price controls are regarded as a temporary and exceptional measure, only effective when coupled with policies designed to reduce the underlying causes of inflation during the wage and price control regime, for example, winning the war being fought. They often have perverse effects, due to the distorted signals they send to the market. Artificially low prices often cause rationing and shortages and discourage future investment, resulting in yet further shortages. The usual economic analysis is that any product or service that is under-priced is overconsumed. For example, if the official price of bread is too low, there will be too little bread at official prices, and too little investment in bread making by the market to satisfy future needs, thereby exacerbating the problem in the long term.

Temporary controls may complement a recession as a way to fight inflation: the controls make the recession more efficient as a way to fight inflation (reducing the need to increase unemployment), while the recession prevents the kinds of distortions that controls cause when demand is high. However, in general the advice of economists is not to impose price controls but to liberalize prices by assuming that the economy will adjust and abandon unprofitable economic activity. The lower activity will place fewer demands on whatever commodities were driving inflation, whether labor or resources, and inflation will fall with total economic output. This often produces a severe recession, as productive capacity is reallocated and is thus often very unpopular with the people whose livelihoods are destroyed (see creative destruction).

Cost-of-living allowance

For more details on this topic, see Cost of living.

The real purchasing-power of fixed payments is eroded by inflation

unless they are inflation-adjusted to keep their real values constant.

In many countries, employment contracts, pension benefits, and

government entitlements (such as social security) are tied to a cost-of-living index, typically to the consumer price index.[70] A cost-of-living allowance

(COLA) adjusts salaries based on changes in a cost-of-living index.

Salaries are typically adjusted annually in low inflation economies.

During hyperinflation they are adjusted more often.[70] They may also be tied to a cost-of-living index that varies by geographic location if the employee moves.Annual escalation clauses in employment contracts can specify retroactive or future percentage increases in worker pay which are not tied to any index. These negotiated increases in pay are colloquially referred to as cost-of-living adjustments ("COLAs") or cost-of-living increases because of their similarity to increases tied to externally determined indexes.

II). Fiscal Measures

Fiscal measures to control inflation include taxation, government expenditure and public borrowings. The government can also take some protectionist measures (such as banning the export of essential items such as pulses, cereals and oils to support the domestic consumption, encourage imports by lowering duties on import items etc.).

Effects Inflation

General

An increase in the general level of prices implies a decrease in the purchasing power of the currency. That is, when the general level of prices rise, each monetary unit buys fewer goods and services. The effect of inflation is not distributed evenly in the economy, and as a consequence there are hidden costs to some and benefits to others from this decrease in the purchasing power of money. For example, with inflation, those segments in society which own physical assets, such as property, stock etc., benefit from the price/value of their holdings going up, while those who seek to acquire them will need to pay more for them. Their ability to do so will depend on the degree to which their income is fixed. For example, increases in payments to workers and pensioners often lag behind inflation, and for some people income is fixed. Also, individuals or institutions with cash assets will experience a decline in the purchasing power of the cash. Increases in the price level (inflation) erode the real value of money (the functional currency) and other items with an underlying monetary nature.Debtors who have debts with a fixed nominal rate of interest will see a reduction in the "real" interest rate as the inflation rate rises. The real interest on a loan is the nominal rate minus the inflation rate.The formula R = N-I approximates the correct answer as long as both the nominal interest rate and the inflation rate are small. The correct equation is r = n/i where r, n and i are expressed as ratios (e.g. 1.2 for +20%, 0.8 for −20%). As an example, when the inflation rate is 3%, a loan with a nominal interest rate of 5% would have a real interest rate of approximately 2%. Any unexpected increase in the inflation rate would decrease the real interest rate. Banks and other lenders adjust for this inflation risk either by including an inflation risk premium to fixed interest rate loans, or lending at an adjustable rate.

Negative

High or unpredictable inflation rates are regarded as harmful to an overall economy. They add inefficiencies in the market, and make it difficult for companies to budget or plan long-term. Inflation can act as a drag on productivity as companies are forced to shift resources away from products and services in order to focus on profit and losses from currency inflation.[13] Uncertainty about the future purchasing power of money discourages investment and saving.[38] And inflation can impose hidden tax increases, as inflated earnings push taxpayers into higher income tax rates unless the tax brackets are indexed to inflation.With high inflation, purchasing power is redistributed from those on fixed nominal incomes, such as some pensioners whose pensions are not indexed to the price level, towards those with variable incomes whose earnings may better keep pace with the inflation.[13] This redistribution of purchasing power will also occur between international trading partners. Where fixed exchange rates are imposed, higher inflation in one economy than another will cause the first economy's exports to become more expensive and affect the balance of trade. There can also be negative impacts to trade from an increased instability in currency exchange prices caused by unpredictable inflation.

- Cost-push inflation

- High inflation can prompt employees to demand rapid wage increases, to keep up with consumer prices. In the cost-push theory of inflation, rising wages in turn can help fuel inflation. In the case of collective bargaining, wage growth will be set as a function of inflationary expectations, which will be higher when inflation is high. This can cause a wage spiral.[39] In a sense, inflation begets further inflationary expectations, which beget further inflation.

- Hoarding

- People buy durable and/or non-perishable commodities and other goods as stores of wealth, to avoid the losses expected from the declining purchasing power of money, creating shortages of the hoarded goods.

- Social unrest and revolts

- Inflation can lead to massive demonstrations and revolutions. For example, inflation and in particular food inflation is considered as one of the main reasons that caused the 2010–2011 Tunisian revolution[40] and the 2011 Egyptian revolution,[41] according to many observators including Robert Zoellick,[42] president of the World Bank. Tunisian president Zine El Abidine Ben Ali was ousted, Egyptian President Hosni Mubarak was also ousted after only 18 days of demonstrations, and protests soon spread in many countries of North Africa and Middle East.

- Hyperinflation

- If inflation gets totally out of control (in the upward direction), it can grossly interfere with the normal workings of the economy, hurting its ability to supply goods. Hyperinflation can lead to the abandonment of the use of the country's currency, leading to the inefficiencies of barter.

- Allocative efficiency

- A change in the supply or demand for a good will normally cause its relative price to change, signaling to buyers and sellers that they should re-allocate resources in response to the new market conditions. But when prices are constantly changing due to inflation, price changes due to genuine relative price signals are difficult to distinguish from price changes due to general inflation, so agents are slow to respond to them. The result is a loss of allocative efficiency.

- Shoe leather cost

- High inflation increases the opportunity cost of holding cash balances and can induce people to hold a greater portion of their assets in interest paying accounts. However, since cash is still needed in order to carry out transactions this means that more "trips to the bank" are necessary in order to make withdrawals, proverbially wearing out the "shoe leather" with each trip.

- Menu costs

- With high inflation, firms must change their prices often in order to keep up with economy-wide changes. But often changing prices is itself a costly activity whether explicitly, as with the need to print new menus, or implicitly.

- Business cycles

- According to the Austrian Business Cycle Theory, inflation sets off the business cycle. Austrian economists hold this to be the most damaging effect of inflation. According to Austrian theory, artificially low interest rates and the associated increase in the money supply lead to reckless, speculative borrowing, resulting in clusters of malinvestments, which eventually have to be liquidated as they become unsustainable.[43]

Positive

- Labour-market adjustments

- Nominal wages are slow to adjust downwards. This can lead to prolonged disequilibrium and high unemployment in the labor market. Since inflation allows real wages to fall even if nominal wages are kept constant, moderate inflation enables labor markets to reach equilibrium faster.[44]

- Room to maneuver

- The primary tools for controlling the money supply are the ability to set the discount rate, the rate at which banks can borrow from the central bank, and open market operations, which are the central bank's interventions into the bonds market with the aim of affecting the nominal interest rate. If an economy finds itself in a recession with already low, or even zero, nominal interest rates, then the bank cannot cut these rates further (since negative nominal interest rates are impossible) in order to stimulate the economy – this situation is known as a liquidity trap. A moderate level of inflation tends to ensure that nominal interest rates stay sufficiently above zero so that if the need arises the bank can cut the nominal interest rate.[citation needed]

- Mundell–Tobin effect

- The Nobel laureate Robert Mundell noted that moderate inflation would induce savers to substitute lending for some money holding as a means to finance future spending. That substitution would cause market clearing real interest rates to fall.[45] The lower real rate of interest would induce more borrowing to finance investment. In a similar vein, Nobel laureate James Tobin noted that such inflation would cause businesses to substitute investment in physical capital (plant, equipment, and inventories) for money balances in their asset portfolios. That substitution would mean choosing the making of investments with lower rates of real return. (The rates of return are lower because the investments with higher rates of return were already being made before.)[46] The two related effects are known as the Mundell–Tobin effect. Unless the economy is already overinvesting according to models of economic growth theory, that extra investment resulting from the effect would be seen as positive.

- Instability with deflation

- Economist S.C. Tsaing noted that once substantial deflation is expected, two important effects will appear; both a result of money holding substituting for lending as a vehicle for saving.[47] The first was that continually falling prices and the resulting incentive to hoard money will cause instability resulting from the likely increasing fear, while money hoards grow in value, that the value of those hoards are at risk, as people realize that a movement to trade those money hoards for real goods and assets will quickly drive those prices up. Any movement to spend those hoards "once started would become a tremendous avalanche, which could rampage for a long time before it would spend itself."[48] Thus, a regime of long-term deflation is likely to be interrupted by periodic spikes of rapid inflation and consequent real economic disruptions. Moderate and stable inflation would avoid such a seesawing of price movements.

- Financial market inefficiency with deflation

- The second effect noted by Tsaing is that when savers have substituted money holding for lending on financial markets, the role of those markets in channeling savings into investment is undermined. With nominal interest rates driven to zero, or near zero, from the competition with a high return money asset, there would be no price mechanism in whatever is left of those markets. With financial markets effectively euthanized, the remaining goods and physical asset prices would move in perverse directions. For example, an increased desire to save could not push interest rates further down (and thereby stimulate investment) but would instead cause additional money hoarding, driving consumer prices further down and making investment in consumer goods production thereby less attractive. Moderate inflation, once its expectation is incorporated into nominal interest rates, would give those interest rates room to go both up and down in response to shifting investment opportunities, or savers' preferences, and thus allow financial markets to function in a more normal fashion.

Causes

Historically, a great deal of economic literature was concerned with the question of what causes inflation and what effect it has. There were different schools of thought as to the causes of inflation. Most can be divided into two broad areas: quality theories of inflation and quantity theories of inflation. The quality theory of inflation rests on the expectation of a seller accepting currency to be able to exchange that currency at a later time for goods that are desirable as a buyer. The quantity theory of inflation rests on the quantity equation of money, that relates the money supply, its velocity, and the nominal value of exchanges. Adam Smith and David Hume proposed a quantity theory of inflation for money, and a quality theory of inflation for production.[citation needed]Currently, the quantity theory of money is widely accepted as an accurate model of inflation in the long run. Consequently, there is now broad agreement among economists that in the long run, the inflation rate is essentially dependent on the growth rate of money supply relative to the growth of the economy. However, in the short and medium term inflation may be affected by supply and demand pressures in the economy, and influenced by the relative elasticity of wages, prices and interest rates.[31] The question of whether the short-term effects last long enough to be important is the central topic of debate between monetarist and Keynesian economists. In monetarism prices and wages adjust quickly enough to make other factors merely marginal behavior on a general trend-line. In the Keynesian view, prices and wages adjust at different rates, and these differences have enough effects on real output to be "long term" in the view of people in an economy.

Keynesian view

Keynesian economics proposes that changes in money supply do not directly affect prices, and that visible inflation is the result of pressures in the economy expressing themselves in prices.There are three major types of inflation, as part of what Robert J. Gordon calls the "triangle model":[49]

- Demand-pull inflation is caused by increases in aggregate demand due to increased private and government spending, etc. Demand inflation encourages economic growth since the excess demand and favourable market conditions will stimulate investment and expansion.

- Cost-push inflation, also called "supply shock inflation," is caused by a drop in aggregate supply (potential output). This may be due to natural disasters, or increased prices of inputs. For example, a sudden decrease in the supply of oil, leading to increased oil prices, can cause cost-push inflation. Producers for whom oil is a part of their costs could then pass this on to consumers in the form of increased prices. Another example stems from unexpectedly high Insured Losses, either legitimate (catastrophes) or fraudulent (which might be particularly prevalent in times of recession).[citation needed]

- Built-in inflation is induced by adaptive expectations, and is often linked to the "price/wage spiral". It involves workers trying to keep their wages up with prices (above the rate of inflation), and firms passing these higher labor costs on to their customers as higher prices, leading to a 'vicious circle'. Built-in inflation reflects events in the past, and so might be seen as hangover inflation.

The effect of money on inflation is most obvious when governments finance spending in a crisis, such as a civil war, by printing money excessively. This sometimes leads to hyperinflation, a condition where prices can double in a month or less. Money supply is also thought to play a major role in determining moderate levels of inflation, although there are differences of opinion on how important it is. For example, Monetarist economists believe that the link is very strong; Keynesian economists, by contrast, typically emphasize the role of aggregate demand in the economy rather than the money supply in determining inflation. That is, for Keynesians, the money supply is only one determinant of aggregate demand.

Some Keynesian economists also disagree with the notion that central banks fully control the money supply, arguing that central banks have little control, since the money supply adapts to the demand for bank credit issued by commercial banks. This is known as the theory of endogenous money, and has been advocated strongly by post-Keynesians as far back as the 1960s. It has today become a central focus of Taylor rule advocates. This position is not universally accepted – banks create money by making loans, but the aggregate volume of these loans diminishes as real interest rates increase. Thus, central banks can influence the money supply by making money cheaper or more expensive, thus increasing or decreasing its production.

A fundamental concept in inflation analysis is the relationship between inflation and unemployment, called the Phillips curve. This model suggests that there is a trade-off between price stability and employment. Therefore, some level of inflation could be considered desirable in order to minimize unemployment. The Phillips curve model described the U.S. experience well in the 1960s but failed to describe the combination of rising inflation and economic stagnation (sometimes referred to as stagflation) experienced in the 1970s.

Thus, modern macroeconomics describes inflation using a Phillips curve that shifts (so the trade-off between inflation and unemployment changes) because of such matters as supply shocks and inflation becoming built into the normal workings of the economy. The former refers to such events as the oil shocks of the 1970s, while the latter refers to the price/wage spiral and inflationary expectations implying that the economy "normally" suffers from inflation. Thus, the Phillips curve represents only the demand-pull component of the triangle model.

Another concept of note is the potential output (sometimes called the "natural gross domestic product"), a level of GDP, where the economy is at its optimal level of production given institutional and natural constraints. (This level of output corresponds to the Non-Accelerating Inflation Rate of Unemployment, NAIRU, or the "natural" rate of unemployment or the full-employment unemployment rate.) If GDP exceeds its potential (and unemployment is below the NAIRU), the theory says that inflation will accelerate as suppliers increase their prices and built-in inflation worsens. If GDP falls below its potential level (and unemployment is above the NAIRU), inflation will decelerate as suppliers attempt to fill excess capacity, cutting prices and undermining built-in inflation.[51]

However, one problem with this theory for policy-making purposes is that the exact level of potential output (and of the NAIRU) is generally unknown and tends to change over time. Inflation also seems to act in an asymmetric way, rising more quickly than it falls. Worse, it can change because of policy: for example, high unemployment under British Prime Minister Margaret Thatcher might have led to a rise in the NAIRU (and a fall in potential) because many of the unemployed found themselves as structurally unemployed (also see unemployment), unable to find jobs that fit their skills. A rise in structural unemployment implies that a smaller percentage of the labor force can find jobs at the NAIRU, where the economy avoids crossing the threshold into the realm of accelerating inflation.

Unemployment

A connection between inflation and unemployment has been drawn since the emergence of large scale unemployment in the 19th century, and connections continue to be drawn today. However, the unemployment rate generally only affects inflation in the short term but not the long term.[52] In the long term, the velocity of money supply measures such as the MZM ("money zero maturity," representing cash and equivalent demand deposits) velocity is far more predictive of inflation than low unemployment.[7]In Marxian economics, the unemployed serve as a reserve army of labour, which restrain wage inflation. In the 20th century, similar concepts in Keynesian economics include the NAIRU (Non-Accelerating Inflation Rate of Unemployment) and the Phillips curve.

Monetarist view

For more details on this topic, see Monetarism.

Monetarists believe the most significant factor influencing inflation or deflation is how fast the money supply grows or shrinks. They consider fiscal policy, or government spending and taxation, as ineffective in controlling inflation.[53] According to the famous monetarist economist Milton Friedman, "Inflation is always and everywhere a monetary phenomenon."[54] Some monetarists, however, will qualify this by making an exception for very short-term circumstances.Monetarists assert that the empirical study of monetary history shows that inflation has always been a monetary phenomenon. The quantity theory of money, simply stated, says that any change in the amount of money in a system will change the price level. This theory begins with the equation of exchange:

is the nominal quantity of money.

is the nominal quantity of money. is the velocity of money in final expenditures;

is the velocity of money in final expenditures; is the general price level;

is the general price level; is an index of the real value of final expenditures;

is an index of the real value of final expenditures;

) to the quantity of money (M).

) to the quantity of money (M).Monetarists assume that the velocity of money is unaffected by monetary policy (at least in the long run), and the real value of output is determined in the long run by the productive capacity of the economy. Under these assumptions, the primary driver of the change in the general price level is changes in the quantity of money. With exogenous velocity (that is, velocity being determined externally and not being influenced by monetary policy), the money supply determines the value of nominal output (which equals final expenditure) in the short run. In practice, velocity is not exogenous in the short run, and so the formula does not necessarily imply a stable short-run relationship between the money supply and nominal output. However, in the long run, changes in velocity are assumed to be determined by the evolution of the payments mechanism. If velocity is relatively unaffected by monetary policy, the long-run rate of increase in prices (the inflation rate) is equal to the long run growth rate of the money supply plus the exogenous long-run rate of velocity growth minus the long run growth rate of real output.[9]

Rational expectations theory

For more details on this topic, see Rational expectations theory.

Rational expectations theory holds that economic actors look rationally into the future when trying to maximize their well-being, and do not respond solely to immediate opportunity costs and pressures. In this view, while generally grounded in monetarism, future expectations and strategies are important for inflation as well.A core assertion of rational expectations theory is that actors will seek to "head off" central-bank decisions by acting in ways that fulfill predictions of higher inflation. This means that central banks must establish their credibility in fighting inflation, or economic actors will make bets that the central bank will expand the money supply rapidly enough to prevent recession, even at the expense of exacerbating inflation. Thus, if a central bank has a reputation as being "soft" on inflation, when it announces a new policy of fighting inflation with restrictive monetary growth economic agents will not believe that the policy will persist; their inflationary expectations will remain high, and so will inflation. On the other hand, if the central bank has a reputation of being "tough" on inflation, then such a policy announcement will be believed and inflationary expectations will come down rapidly, thus allowing inflation itself to come down rapidly with minimal economic disruption.

Heterodox views

There are also various heterodox theories that downplay or reject the views of the Keynesians and monetarists.Austrian view

See also: Austrian School and Monetary inflation

The Austrian School asserts that inflation is an increase in the money supply, rising prices are merely consequences and this semantic difference is important in defining inflation.[55] Austrians stress that inflation affects prices to various degrees (i.e., that prices rise more sharply in some sectors than in other sectors of the economy). The reason for the disparity is that excess money will be concentrated to certain sectors, such as housing, stocks or health care. Because of this disparity, Austrians argue that the aggregate price level can be very misleading when observing the effects of inflation. Austrian economists measure inflation by calculating the growth of new units of money that are available for immediate use in exchange, that have been created over time.[56][57][58]Critics of the Austrian view point out that their preferred alternative to fiat currency intended to prevent inflation, commodity-backed money, is likely to grow in supply at a different rate than economic growth. Thus it has proven to be highly deflationary and destabilizing, including in instances where it has caused and prolonged depressions.[59]

Real bills doctrine

Main article: Real bills doctrine

Within the context of a fixed specie basis for money, one important controversy was between the quantity theory of money and the real bills doctrine (RBD). Within this context, quantity theory applies to the level of fractional reserve accounting allowed against specie, generally gold, held by a bank. Currency and banking schools of economics argue the RBD, that banks should also be able to issue currency against bills of trading, which is "real bills" that they buy from merchants. This theory was important in the 19th century in debates between "Banking" and "Currency" schools of monetary soundness, and in the formation of the Federal Reserve. In the wake of the collapse of the international gold standard post 1913, and the move towards deficit financing of government, RBD has remained a minor topic, primarily of interest in limited contexts, such as currency boards. It is generally held in ill repute today, with Frederic Mishkin, a governor of the Federal Reserve going so far as to say it had been "completely discredited."The debate between currency, or quantity theory, and banking schools in Britain during the 19th century prefigures current questions about the credibility of money in the present. In the 19th century the banking school had greater influence in policy in the United States and Great Britain, while the currency school had more influence "on the continent", that is in non-British countries, particularly in the Latin Monetary Union and the earlier Scandinavia monetary union.

No comments:

Post a Comment